does instacart automatically take out taxes

Yes Instacart takes out tax and it means we can help you manage your tax obligations for you. The short answer is no if youre an Instacart full-time shopper.

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make

Instacart uses a platform called Stripe Express which allows you to view your earnings review your tax information and download tax forms including 1099 Instacart tax forms.

. However Instacart will automatically take out your taxes if youre an in-store. Surface Studio vs iMac Which Should You Pick. If you earned at least 600 delivery groceries over the course of the year including base pay.

Fortunately you dont have to pay tax on your total earnings from Instacart. Instacart shoppers are required to file a tax return. Instacart doesnt pay for gas or other expenses.

Deductions are important and the biggest one is. Yes - in the US everyone who makes income pays taxes. Instacart Shoppers weve put.

They will pay Instacart shopper taxes in the same manner as those who work regular 9-to-5 jobs. Just make sure you keep. Instacart shoppers are required to file a tax.

Instacart doesnt take out taxes. If you make more than 600 per tax year theyll send you a 1099-MISC tax form. Does Instacart take out taxes for its employees.

There are a few different taxes involved when you place an order Sales tax. The answer to the question does Instacart deliver a. One of the many perks of self-employment is that you can deduct business expenses.

To actually file your Instacart taxes youll need the right tax form. For its part-time shoppers Instacart doesnt take out taxes and they file W-2s. The first question that comes into ones mind is Does everyone who works for instacart have to pay taxes The answer to the question is no not everyone has to pay taxes.

5 Ways to Connect Wireless Headphones to TV. For simplicity my accountant suggested using 30 to estimate taxes. What Taxes Do Instacart Shoppers Need to Pay.

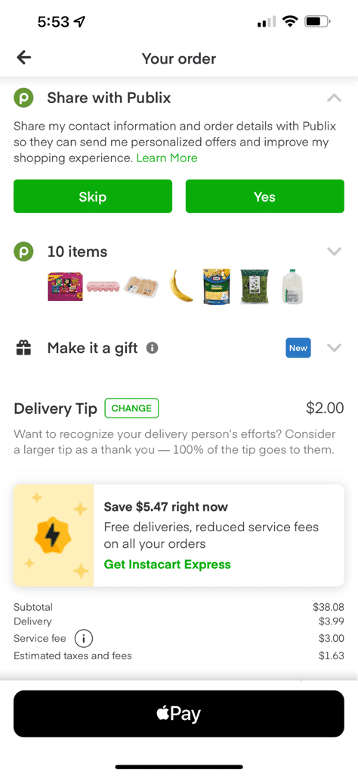

Instacart processes refunds immediately but they sometimes take 5-10 business days to show in your bank or credit card. The sales tax may be applied to some or all of the items in your order in accordance with local laws depending on. Get Help With Your Taxes.

Everybody who makes income in the US. Instacart can tell you if youre eligible. Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes.

The estimated rate accounts for Fed payroll and income taxes. Do Instacart take out taxes. Has to pay taxes.

To actually file your Instacart. You have to pay. Instacart does take out taxes if you are an in-store shopper but do not worry if you are a full-time instacart shopper there is no tax for them.

For gig workers like Instacart shoppers they are required to file a tax return and pay taxes if they make over 400 in a year. The rate from January 1 to June 30 2022 is 585 cents per mile. Youll need to set aside money to pay taxes each quarter more below.

Do You Have to Pay Taxes on Instacart. This is a standard tax form for contract workers.

How Does Instacart Work And How Much Does It Cost

Delivery Taxes Guide How To File Your Taxes As A Doordash Instacart Uber Eats Courier

Instacart Taxes The Complete Guide For Shoppers Ridester Com

The Ultimate Tax Guide For Instacart Shoppers Stride Blog

I Saved Money On Instacart Delivery With A Credit Card Promotion

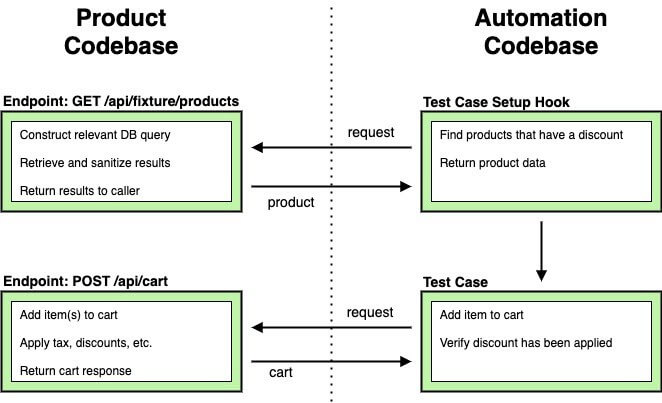

Understanding Software Quality At Scale

When Does Instacart Pay Me A Contracted Employee S Guide

Everlance Automatic Mileage Tracker Expense Management

Does Instacart Track Mileage The Ultimate Guide For Shoppers

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

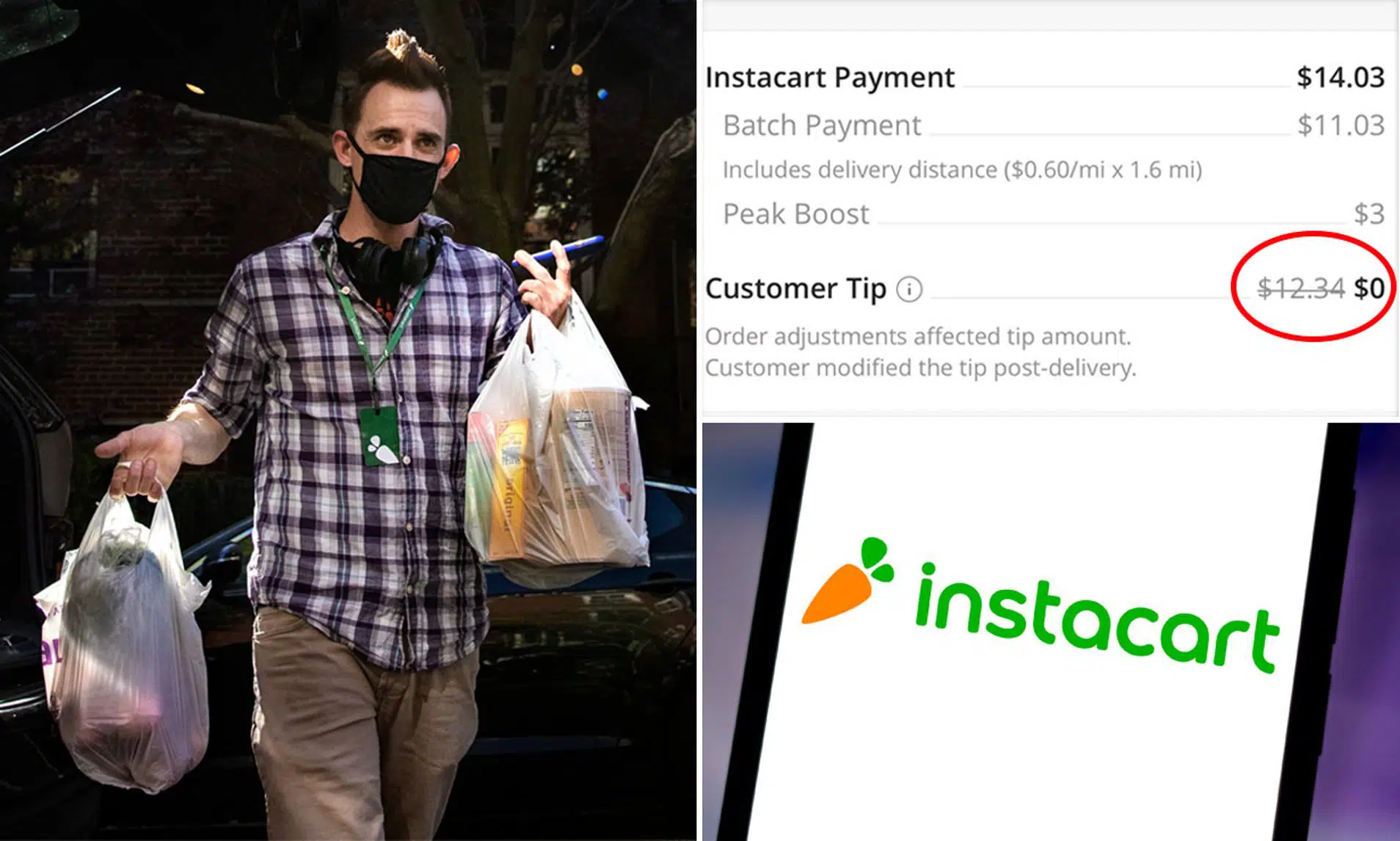

Instacart Here S Our 22 Cents No More Tip Theft Low Pay And Black Box Pay Algorithms

The Ultimate Tax Guide For Instacart Shoppers Stride Blog

How Much Do Instacart Shoppers Make 2021 Update Gridwise

Doordash Taxes Does Doordash Take Out Taxes How They Work

Instacart Shopper Earnings For Q1 2022 Gridwise

All You Need To Know About Instacart 1099 Taxes

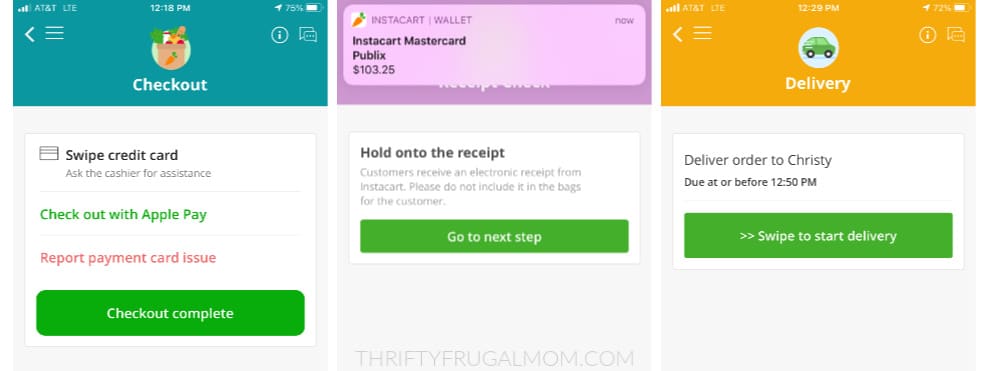

Instacart Shopper Review Made Over 1 550 Mo Working Part Time Thrifty Frugal Mom